Are you interested in the ups and downs of the stock market? Has anyone ever wondered what causes market collapses and how they affect investors? If so, you're on the correct track.

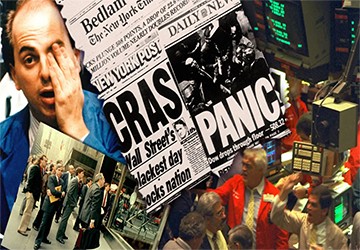

This article will discuss the stock market's history, exploring the eight most significant market declines and the lessons they teach us.

Whether you're an experienced investor or just learning, understanding these market declines will help you confidently understand and navigate the market.

So, let's explore the intriguing world of stock market failures and discover the lessons they contain.

8 Eyecatching stock market failures and their essential lessons.

These stories aren't just historical facts but also important lessons that will help you make informed decisions about investments. Let's discuss these colls with nhau!

Crash 1: The Great Depression (1929)

The Great Depression is considered an ikonic failure that reached across the globe; it's a sobering reminder of the cyclical nature of markets.

As we investigate the causes and effects of this collision, we can understand the value of regulation, diversification, and government involvement.

Discover how adaptability and resilience are crucial to investors to survive the storm.

Crash 2: Black Monday (1987)

The day after the Black Monday stock market decline, questions are being asked about the market's volatility and investor hysteria.

Discover what caused this devastating event and the essential lessons on risk management, the dangers of herd mentality, and the value of safeguards to preserve your portfolio.

Crash 3: The Dotcom Bubble (2000)

The millennium's turn witnessed the dotcom bubble's burst, which shook the technology sector's foundations.

By studying this accident, we can understand the risks of speculative investment, the necessity of fundamental analysis, and the importance of a balanced portfolio creation approach.

Educate yourself on the past errors that led to informed decisions in the evolving technology industry.

Crash 4: The Global Financial Crisis of 2008 (also known as the Great Depression of the World)

The global financial crisis of 2008 had a significant effect that was long-lasting on the worldwide economy.

Discover the intricate web of causes associated with this tragedy, including subpar mortgages and overleverage, and gain knowledge about risk management, the role of financial institutions, and the value of transparency and accountability.

Crash 5: Flash Crash (2010)

The abrupt and dramatic flash crash of 2010 demonstrates the increasing influence of automated trading systems and algorithmic trading.

Understand the exposed vulnerabilities associated with this accident, such as the need for circuit breakers in the market and the fragmentation of the market.

Discover the effects of technological advances and the necessity of maintaining market decência.

Crash 6: The European Sovereign Debt Crisis (2011)

The European sovereign debt crisis occurred alongside concerns about the eurozone's stability.

Explore the intricacies of this crisis, the interactions between fiscal policies, and the lessons on risk assessment, diversification, and the necessity of international cooperation.

Understand the ripple effects of geopolitical situations on the global economy.

Crash 7: Chinese stock market failure (2015)

The Chinese stock market's collapse in 2015 is a warning about the dangers of over-exuberant speculation and the difficulty transitioning from a capitalist to a socialist economy.

Investigate the causes of this collision, including margin trading and government involvement, and learn what is essential in understanding the market dynamics when purchasing from emerging markets.

Crash 8:COVID-19 Pandemic Crash (2020)

The unprecedented nature of the COVID-19 pandemic led to a severe decline in the global economy; this led to a significant drop in stock prices worldwide.

Reflect on the lessons of this accident, including the value of diversification, risk management, and the sustainability of specific industries during times of trouble. Discover how flexibility and long-term thinking can assist investors in weathering the storm.

Discovering the Lessons of History

As we conclude our trip through these eight significant stock market declines, it's apparent that history significantly impacts us.

From the Great Depression to the COVID-19 pandemic, each catastrophe highlights the value of risk management, diversification, and intelligent decision-making.

By understanding the causes and effects of these incidents, investors can have more confidence in a more resilient stock market.

Remember, the past is a significant teacher, and the lessons learned can positively impact a more financially advantageous future.

FAQs

Q: Why should I concern myself with the stock market's past?

Ans: Understanding the history of stock market failures provides essential information about the pattern of market declines, their triggers, and their effects. By studying past errors, you can more easily predict and prepare for upcoming market changes. This understanding grants you the power to make informed investment decisions and reduce the risk of potential harm.

Q: What can I learn from these market failures?

Ans: Every collision has a different set of lessons for investors. For instance, you can learn the value of diversification, risk management, and avoiding a herd mentality. Additionally, understanding the role of regulations, government actions, and technological advances can assist you in navigating the market more rapidly and confidently.

Q: How can these lessons help me as a financial investor?

Ans: By studying these incidents, you will better grasp the causes that may affect the market and your finances. This understanding lets you recognize potential dangers, make more informed decisions, and create a long-term investment plan. The lessons learned from history can serve as a guide to help you preserve your portfolio and increase your probability of financial success.